Acquire assets or securities that are not available to the public, potentially leading to greater returns on investment

Innovative Investment Firm With Over $2 Billion Of Completed Transactions

Early-Stage | Angel | Seed | Series A | Series B

significant

experience

- Aerospace

- Technology

- Food

- Real Estate

- Consumer Goods

22

Equity/Junior Capital Investments

32

Venture Capital Investments

5%

Top Percentile ROI Performance

$2B+

Completed Transaction

operational and real estate transactions with prior deals

ROI performance in the top 5% of comparable organizations

Private Purchases

Public Tender Offers

Acquire a controlling stake in another firm, allowing them to increase market share, diversify their product offerings, and potentially realize significant cost synergies.

Early-Stage Venture Capital

Early-Stage Venture Capital

Funding and support for innovative startups with the potential to disrupt entire industries and drive significant economic growth.

Take Privates

Significant advantages in terms of operational flexibility, strategic decision-making, and cost savings, making it an attractive option for investors seeking to unlock value in a business.

Chapter 11 Reorganizations

Restructure debts and operations, potentially allowing opportunity to emerge as stronger, more profitable entities.

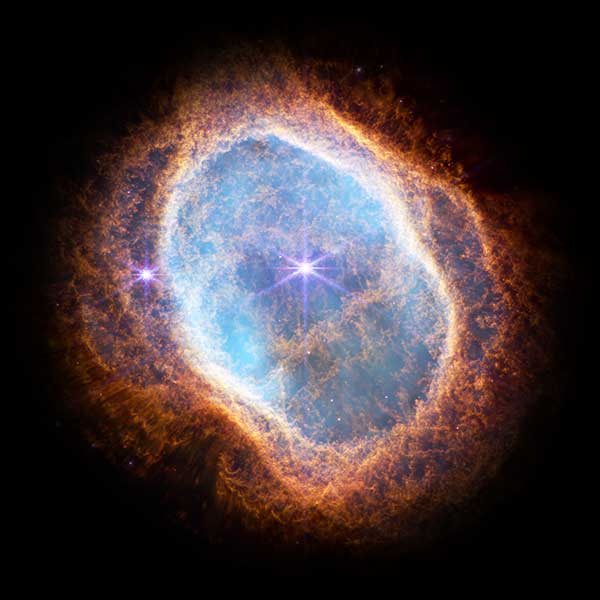

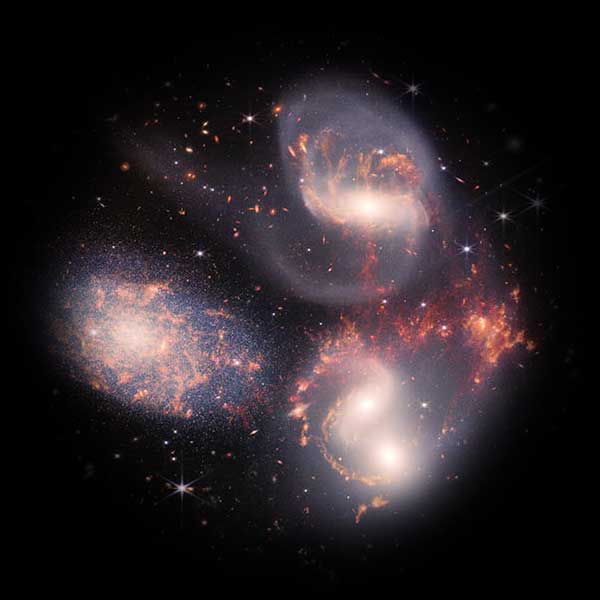

Portfolio

Purchases

Diversify holdings and potentially achieve long-term growth by purchasing a basket of assets that align with investment goals and risk tolerance.

Winning expertise in

Sourcing, Structuring, Due Diligence, Debt Placement, Partner Selection, Legal, & Operational Monitoring

Sourced and co-sponsored transactions with several industry leading investors including:

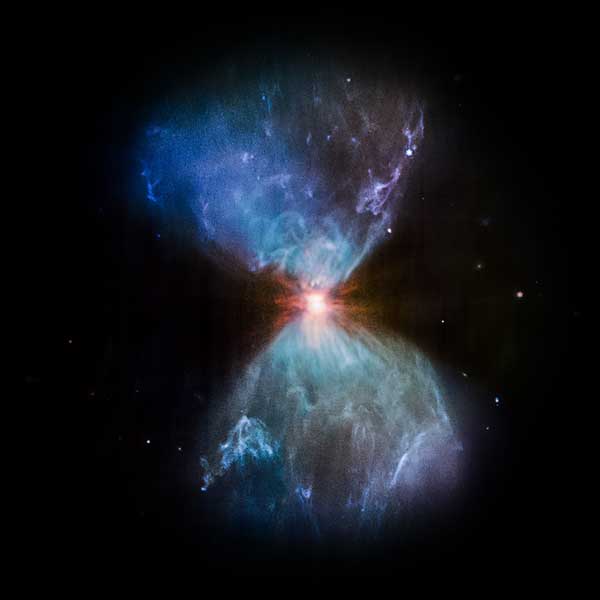

investing in artificial intellegence

Entera.ai

“180 Capital understood our vision in the machine learning and real estate crossover. They supported us at a very early stage to help form the unicorn that is celebrated today.”

– Marty Kay, CEO/Founder

|  |  |  |

| Home Products International (with Sam Zell’s EGI) | Lee Cooper Jeans (with Sun Capital) | The Mexmil Company (Triyar Capital) | Prandium (with Kimco Realty) |

Monarch Dental (with Gryphon Investors) |  Apex Technologies (with Berggruen 180 L.P.) |  Coast Plating/CSL (with Gemini Investors) |  FlavorHawk LLC (early stage) |